Evergrande is a holding company that managed to become China's largest real estate developer, driven by the rapid population growth of China's cities. It now has debt equivalent to 2% of China's GDP, around 2 trillion yuan or USD 309 billion. Its financial situation is precarious because the share price on the Hang Seng index has plummeted 82% so far this year.

The growth of large cities is often linked to economic growth and development, as has been experienced in China. It was accentuated in the aftermath of the 2008-09 financial crisis, as global trade contracted when the Chinese central government issued a massive stimulus package that facilitated private borrowing by individuals and businesses.

The growing demand for higher quality urban housing and the ease of borrowing triggered substantial growth in the real estate sector. As a result, land prices skyrocketed in all urban centres, and real estate development became a thriving business. Buyers paid a portion of the property upfront and mortgaged the difference. Evergrande expanded on this basis. Like the entire real estate sector, the holding company borrowed against land as collateral, and the more significant, the better the credit, with lower interest rates. This cycle stops when property prices stagnate or when the government regulates prepayment. Real estate accounts for at least 15% of the country's workers, between construction and real estate services, and more than 70% of China's urban wealth.

For these reasons, the demand for land increased and drove housing prices consistently upwards, while at the same time, real estate companies became increasingly indebted. For this reason, in 2020, the People's Bank of China and the Ministry of Housing and Urban-Rural Development announced new financing rules for real estate companies. They will assess developers wishing to refinance against three thresholds: a) a 70% cap on the liability/asset ratio, excluding upfront sales proceeds; b) a 100% cap on the net debt/total equity ratio; c) a cash-to-short-term loan ratio of at least one.

Before 2020, the holding started to take more risks and diversify its activities. It expanded into the development of electric cars (Evergrande Auto), theme parks, mineral waters, and a football club in Guangzhou. In 2020 the firm started having trouble covering its debts and requested help from local government officials to avoid a cash shortage. However, because of pandemic recovery plans and fears of being cut off from products such as microchips, the government declared that improved scientific research and greater technological self-sufficiency were its main economic goals.

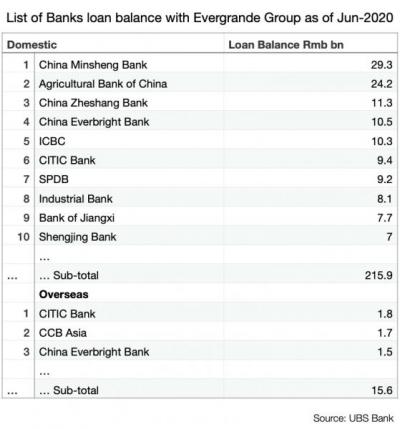

As investors lost confidence, its largest bank creditor began to slow down its lending. Some of its activities, such as the operation of electric vehicles, absorbed much of its cash. China's Ministry of Housing and Urban-Rural Development warned Evergrande's significant lenders on 15 September not to expect interest payments due on bank loans maturing on the 20th. Since state-owned lenders dominate the financial system, the government can manage the impact of defaults. However, international credits are outside its sphere.

The Housing Authorities recently warned Evergrande's creditors that it could trigger a possible international financial collapse comparable to Lehman Brothers (2008). However, the situation is different because the bulk of the debt is within the Chinese financial system, closed to international investment. Only 26% of the total amount owed is to international investors and could impact the market.

Evergrande's default is a serious problem for China. For the US, however, it is not a Lehman moment because such debt does not trade mostly in its market. Consider the discussions in the US Congress on the Government budget extension which, if not, could lead to a default on US Treasury bonds in January 2022. This is a much more serious and global issue, because it affects all central banks in the world.