The energy transition has made lithium a critical element. In Latin America, the issue has gained momentum since the beginning of the second decade of the 21st century, during the administration of Evo Morales. It is a priority issue for the region, as it has the most significant volume of reserves and can take advantage of the growing global demand for lithium. This article will address the current importance of this element for the region and the findings in Mexico and Peru.

The energy transition has forced the use of technology and inputs other than those related to hydrocarbons. The growing consumption and development of electric and hybrid vehicles have created an increasing demand for lithium. Currently, the primary use of the element is in the production of rechargeable batteries. In 2014, 29% of the world's lithium went to rechargeable batteries; this percentage increased to 71 % in 2021.

Lithium has gained an essential place in the dispute for global hegemony. When it was recognised that lithium would be vital to the energy transition of the vehicle fleet, this mineral became a strategic material. Since 2008, the US Department of Energy considers lithium one of the 16 critical elements.

Lithium trade is divided into three: mineral concentrates, mineral compounds, and refined metal. Lithium ores, mainly spodumene, petalite, and lepidolite, are extracted from pegmatites (rock deposits) and are used primarily as raw materials for glass and ceramics. Most lithium compounds (e.g., lithium carbonate, lithium chloride, and lithium hydroxide) come from brines. Lithium metal is obtained by electrolysis from lithium chloride.

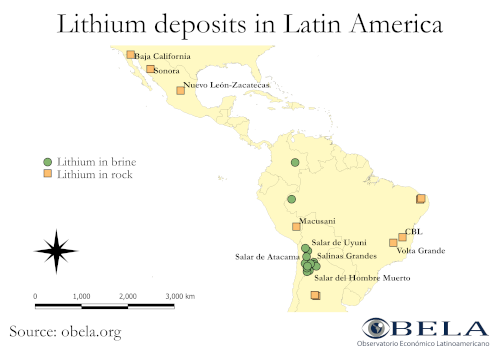

As can be seen in the maps above, Argentina, Bolivia, and Chile have most of the deposits in salt flats. Recently, significant deposits have been discovered in pegmatite (rock) in Brazil, Mexico, and Peru. The mines in Mexico and Peru are still in the exploration phase, although they are among the largest in the world.

Latin America stands out for its immense lithium reserves. Bolivia, Argentina, and Chile are the three countries with the largest reserves of this material, and the area is known as the "lithium triangle." During 2019, Bolivia's state-owned Yacimientos de Litio Bolivianos produced just 400 metric tons, a small amount compared to the expected output, and its reserves, representing 21% of the world's total. Argentina and Chile currently have production projects financed by Chinese, German, US, and Canadian capital.

By March 2021, Mexico has 36 projects registered, according to official information from the Ministry of Economy. One of these belongs to Mexican investors. Organimax, a Canadian company, owns 15 of the 36 projects. The rest belong to British, American, French, Spanish, Australian, and Canadian capital. It is noteworthy that there are no projects with Chinese capital, which have shown an essential presence in the rest of the region.

Peru was unknown for large lithium deposits or being a producer of lithium until recently. In mid-2018, there was a significant lithium deposit finding when the Macusani field, Puno, was explored for uranium. This recent finding stands out as the metal is in pegmatite rock rather than in brines, mainly how the large deposits exist in the Triangle. In 2021, the Canadian company Plateau Energy, which owned the project, sold it in its entirety to fellow Canadian company Lithium Americas through the Canadian stock exchange. They have two significant projects: Cauchari-Olaroz in Jujuy, Argentina, and Thacker Pass in Nevada, USA.

The Bolivian coup d'état carried out by foreign interference, such as that of the US and the UK, is one of the clearest examples of the element's interest in the region. On several occasions, the US has stated how crucial the element is for the coming years, and therefore the need to ensure its access to satisfy its demand in the technological competition, where the energy transition is crucial.

The governments of Mexico and Peru have expressed interest in following a similar path to Bolivia. The option of nationalising the element so that the state can exploit and probably process it has been raised. The latter process is a necessary part of an active industrial policy, such as developing during the Evo Morales administration.

The fate of lithium in Peru could be defined by whoever wins the presidential elections in the coming weeks. While Castillo has favoured the idea of nationalising various raw materials, such as minerals and gas, Fujimori is set to continue with a free-market policy, which would leave the element in the hands of foreign investors. While in Mexico, things are unclear, President Andrés Manuel has made public his interest in nationalising it. In Congress, the leading party to which the president belongs is proposing a bill to promote a regulated market with foreign investors.

Lithium and its exploitation in the region have a clash of interests. While the producer countries seek to take advantage of the growing demand for lithium and obtain fiscal revenue from its exploitation, the developed countries want to ensure access to it for rechargeable batteries, indispensable in changing the energy matrix and vehicle fleet. The 2019 coup d'état in Bolivia is just one of the manifestations of this clash of interests. The region's countries need to take firmer action if they are to take advantage of their natural resources and actively use them for development. Otherwise, they could continue with the primary export model without carrying out transformation processes and lose the opportunity to increase the added value of exports and domestic consumption.