Natural gas is a fossil energy seen as an alternative by the EU because it does not pollute as much as coal or oil and has become one of the most coveted energy sources. This shift has led to a transformation of the international market structure, the geopolitical implications of which alter the balance of power between producer and consumer countries. The matter will be reviewed in this article.

The world's foremost natural gas producers are Russia, Iran, Qatar, the United States and Canada, accounting for over half of global production. The main buyers are China, the United States, the European Union, Japan and India, which account for more than three-quarters of world consumption.

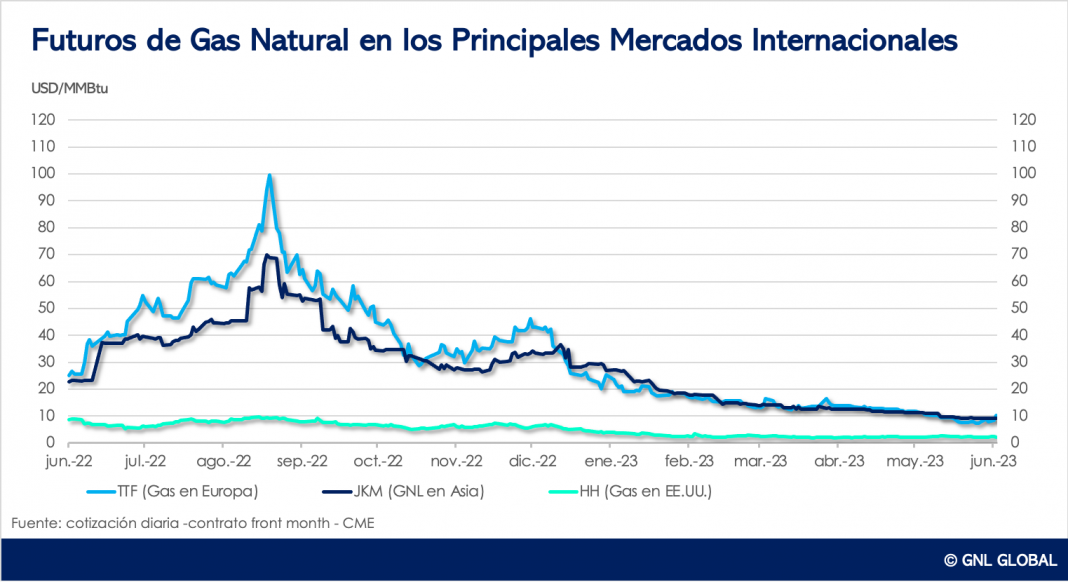

The most crucial gas contracts and futures are traded on the TTF (Title Transfer Facility) in Rotterdam, the JKM (Japan Korea Marker) in Japan and Korea, and the Henry Hub in the United States. Since Russia's special military operation in Ukraine, these markets have seen the effect of the geopolitics surrounding gas.

The European Union imports 80% of the gas it consumes at a price ranging from €13/MMBtu (26.08.2019) to a maximum of €300/MMBtu (26.08.2022). Korea and Japan have seen a similar effect. In the same period, in the USA, gas prices moved from $2.9 (€3.25) to $5.7 (€5.87).

Russia was the main supplier of natural gas to Europe, and Western sanctions led to the interruption of exports, which led to a sudden price increase (from March 2022). Since then, Europe has been buying more gas from the US. In October 2023, it was the largest buyer of US LNG, with an 8% increase, translating into 60% of all gas exports to Europe. Asian customers accounted for 20% of exports, up from 30% in September, and Latin America bought 5%. The EIA (full name for the US) estimates that US LNG Exports will increase by 152% between 2022 and 2050.

Faced with the sanctions imposed by the West, Russia has deepened its gas market with China and India, two of the largest gas consumers. The preferential treatment that Russia has offered them in terms of supply and price allows it to maintain stable local energy markets. Furthermore, transactions are paid for in national currency, without the intervention of the dollar or Swift.

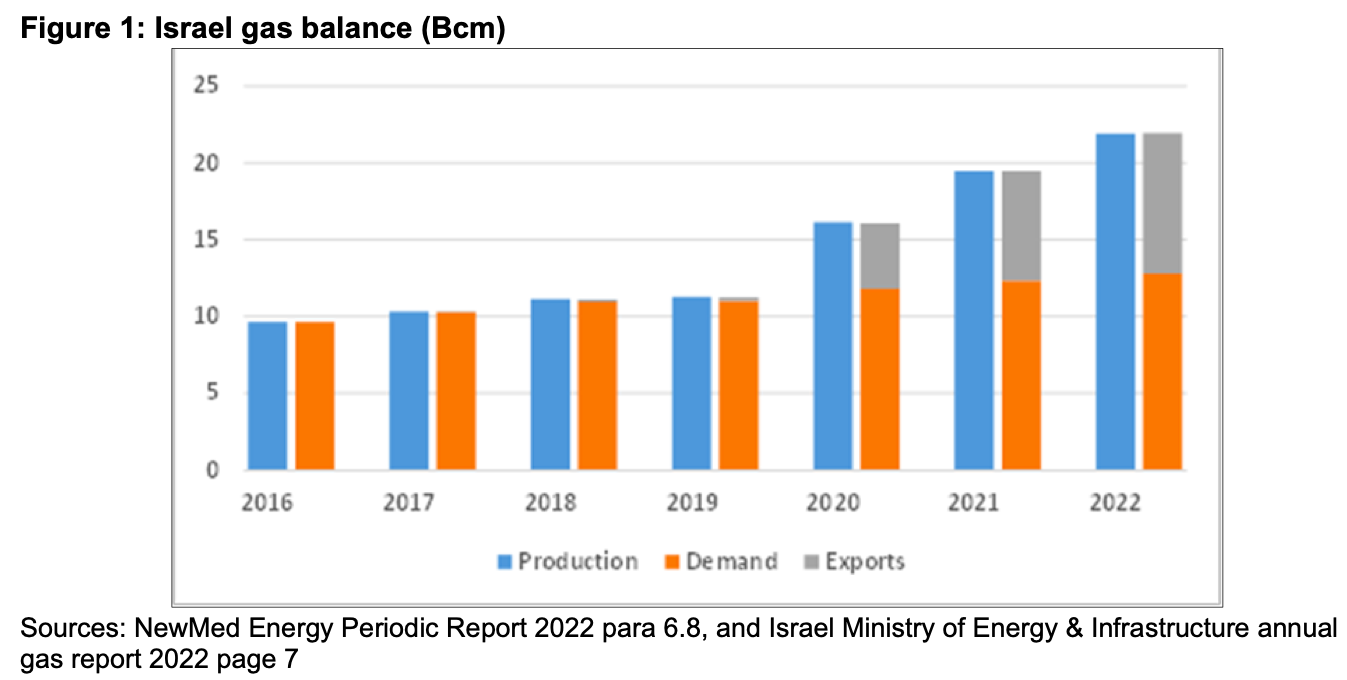

In the race to replace Russia as the leading supplier, Israel, which five years ago was barely self-sufficient, now seeks to become a hub for energy supplies to Europe. Israel has a newly developed gas infrastructure, with a pipeline connecting its gas reserves to the Mediterranean coast. It is also building an LNG regasification terminal, allowing it to import gas from other countries (Qatar) and serve as an export platform to the EU.

Natural gas will be an essential energy source for years to come, and for Europe, it is crucial, which explains its lack of reaction to the war in Palestine. Natural gas-producing countries want to increase their market share, while natural gas-consuming countries are looking to diversify their sources of supply. With Russia sanctioned and Europe footing the bill, the biggest winners from the Special Military Operation in Ukraine are the US and Israel. And in the Palestinian conflict, if Israel controls the territory, it will be the outright winner.