The elephant in the room

- blog de anegrete

- 3148 lecturas

"Countries with reserve currencies can maintain unlimited levels of fiscal deficit and public debt because these have available finance", is the reasoning behind modern monetary theory. The evidence, however, shows that massive deficits do not mean economic dynamism in the United States. The consequence is a delinking of the financial sector from the real economy at the expense of gigantic global income concentration and a frightening boom in the US stock market. There is no evidence of economic recovery due to deficits. There is no evidence of deficits in the US pushing the economy, nor of multipliers operating. There is evidence of inflation.

The most recent data by the BEA indicates that the economic recovery has slowed down in the US in the third quarter of 2021. It happened despite massive and growing deficit injections. It opens the question of the role of deficits and where the money is going.

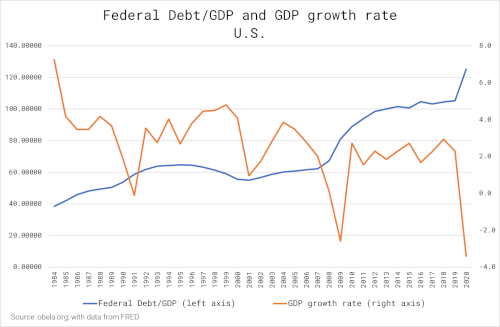

The first significant observation is that after 2008, the federal deficits have doubled from around 60% of GDP to about 120%. It happened while the GDP growth rate slowed down from the 3.1% average from 1998 to 2007 to 2.3% between 2010 and 2019, in constant 2015 dollars. These averages exclude the massive crisis of 2008 and 2020, which would reduce them further. Why is the pace of growth slowing at the same time as deficits are growing? Perhaps because neither public investment multipliers nor consumption multipliers work. Why don't they work? The US gross capital formation/GDP ratio fell from 22.8% to 20.4% in the same two periods. The consumption/GDP ratio rose from 81% of GDP to 83% and the multiplier for this growth was exported rather than staying within the US. Growing corporate profits derived from this phenomenon goes into stock market values and not the real economy,

The interesting element is that defence expenditures lead the federal budget. Military spending formerly had a high multiplier because it pulled the economy, but now that pull is reflected in the sharply growing external deficit. The backward linkages take that expenditure abroad, reflected in the massive and growing external current account deficit. . At the same time, consumption goes away from imported products, as the tremendous support from tax revenues reflects negatively on the fiscal and external twin deficits.

These deficits are possible because an external demand for US T bills by foreign investors exists. They finance the balance of payments deficits. When looking at the data, Central Banks worldwide keep their international reserves in US T bills. In this way, when consumption shrinks in the rest of the world, following D'Arista's comment to Rowden, international reserves grow worldwide, and that goes straight into covering both the US external deficit and the budget. Will the ants holding the rope keep it tight so the elephant will not fall? The ants know that by letting the rope loose, the elephant’s fall will surely crush them. The elephant is sure the ants will not let him go down, so expansive monetary policies can go on forever, and massive deficits can go on forever.

The only problem with this reasoning is that if production does not recover in the US, then growth is transferred from the emerging surplus nations to the leading deficit countries and, in turn, into China. Emerging nations end up moving their resources to China via the US deficit instead of growing, given the world is still one and the borders are all open, and trade is unrestricted. For this to be possible, it is imperative that the world pursue austerity policies while the US sustains growing fiscal and external deficits. Ortiz has explained the massification of austerity. So, wages get reduced in the emerging nations for the benefit of high wages in the US in disproportion to production, resulting in a massive external deficit.

The second problem is that monetary inflation exists and hits first the major deficit country. Pollin is right when he says prices are rising due to oil prices and supplying chain problems. But the excess liquidity injected went into the stock exchange and created a Frankenstein unrelated to the real economy and injected inflation via financial repression. The US debt in nominal amounts is more significant than the rest of the world put together. So monetary inflation does exist and hits home, first, other deficit countries, later, and finally, the rest of the world. The result is that Latin America has now average inflation of over 5%, excluding Venezuela and Argentina. Unfortunately, the monetary tools against inflation are raising interest rates and reducing the injection of liquidity into the economy. If interest rates rise, GDP growth, already sluggish in the US and globally, will slow further. With interest rates returning to a positive level, with a zero real interest rate - it is now in the record financial repression rate of -5.15% in the US - commodity prices will be depressed and emerging economies growth will be held back.

The problem is not that China is coming with a gun extorting their sales. The buyer of last resort, the US, has lost control of its role in keeping its economy and the world in balance. Its unbalance affects the emerging world severely and the least developed countries even more. Victoria Newland's memorable phrase "F**k Europe" perhaps became a paraphrase of John Foster Dulles' "F**k the world. We don't have friends, we have interests, and the interest is to keep the bloated American economy alive". Whatever US economic growth happens in 2022, incredibly projected by the IMF at 4.5% in real terms, it will not pull the rest of the world from sluggish growth, not if interest rates rise and recover to near a cero level in real terms. The global economic recovery is far from over.