Ecuador, Mexico, and Paraguay: 2020's first rebound was from foreign trade

- blog de anegrete

- 4857 lecturas

The world economy came to a halt during the second quarter of 2020 when different governments imposed various productive shutdown and social distancing measures around the world. According to IMF estimates, it brought aggregate demand and supply to a halt, causing the GDP of the European Union to fall by 6.12%, the G7 by 2.10%, and Latin America by 7.01%. In response to the COVID-19 crisis, the fiscal and monetary stimulus expanded in almost all Latin American economies to boost recovery, although not all countries responded immediately.

There are three groups of countries: the first is composed of Ecuador, Mexico, and Paraguay, where a small stimulus package accompanied increased economic activity; the second by Argentina, Chile, and the Dominican Republic, which had fiscal and monetary stimulus with a weak rebound; and the third by Brazil, Peru, and Panama where a more robust recovery matched budgetary and financial incentive. This text will address only the first two sub-groups and explain that the difference is due to the demand of the main trading partners and the previous growth of the economies.

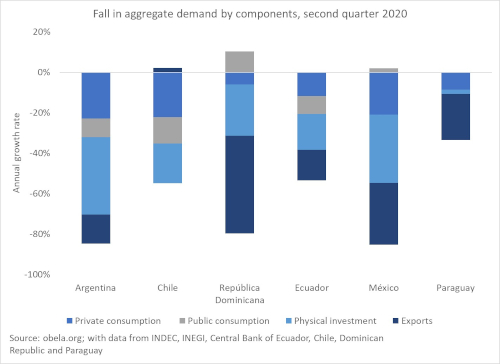

One consequence of the slowdown in production and social distancing was that domestic demand fell compared to 2019 in all countries. The economies most affected were the largest: in Argentina, private consumption decreased 23%, in Chile 22% and Mexico 21%, while investment fell 38%, 20%, and 34%, respectively. On the other hand, external demand performed better for those economies where the link is more substantial with international trade, whether led by the US or China.

The rebound of the first group of countries, those injecting few public resources and improving GDP, in the third quarter of 2020 is due to the recovery of external demand. Its main trading partners are the US for Ecuador and Mexico, with 29.5% and 75.1% of its total products, mainly fuels and automotive and electronics manufacturing, going to the US market. The relaxation of sanitary measures in the US and the vast fiscal injection restored the pace of imports. Private investment reacted to this increased demand in export industries, which positively boosted GDP. However, the recovery of the domestic market has a long way to go.

As for Paraguay, its leading sales to MERCOSUR are electricity, seeds, and oleaginous fruits. During the health contingency in the second quarter, electricity shipments to Brazil and Argentina fell, and the rebound is export-led by soybeans to Brazil and meat to Chile. In Paraguay, domestic demand did not fall as sharply as in the other countries and investment, public and private, is growing strongly, explained by the construction sector, which has been increasing since mid-2019. The recovery of its domestic market has a short way to reach the point where it contracted.

In the second group, where a high rebound did not accompany the high fiscal stimulus, foreign trade had different effects. Chile's exports did not decline because its leading trading partner is China, followed by the Asia Pacific region, and commodity prices increased due to lower international interest rates. Exports of copper, iron, and lithium carbonate to these countries maintained their external demand.

On the other hand, Argentina's exports, instead of recovering, declined. Its shipments of soybean residues to Asia, used for animal feed, and cereals were the most affected. Concerning the Dominican Republic, its leading trading partner is the US, representing 53.8% of its exports. As in Mexico and Ecuador, the economic reactivation of the US market restored its sales to that country.

The decline in GDP in Argentina, Chile, and the Dominican Republic are due mainly to falling domestic demand, and the increase in the pace of international trade contained the decline. Still, it did not improve economic activity in the third quarter, as in other countries. However, the second group's significant fiscal and monetary stimulus started to have a substantial impact on their growth at the end of 2020. At the end of the year, they performed better economically than Ecuador, Mexico, and Paraguay, which spent little.

Finally, not in all cases the dynamics of world trade express the pace of total domestic production, nor does the increase in fiscal spending ensure a rapid economic recovery. The COVID-19 crisis has shown that export-led growth can speed up GDP recovery in some cases, in the context of falling imports. The export-related sector can speed up and show greater dynamism than those dependent on the domestic market and subject to fiscal stimulus for their revival.