Inflation is more than a monetary problem.

- blog de bacosta

- 606 lecturas

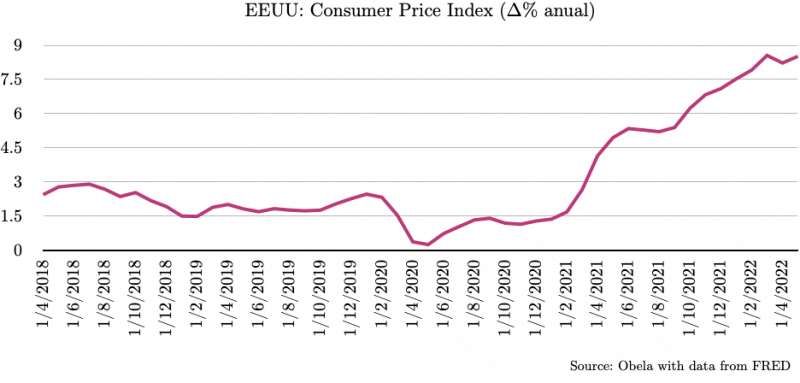

On June 15, the Fed raised its target interest rate by 75 basis points, the most substantial increase since 1994. The rate has already reached 1.75%, the pre-pandemic level. It does not seem to be enough; the expectation is that it will get 3.5% by the end of the year. Meanwhile, political and media discourses are looking for who to blame for the highest inflation rate in the last 40 years. A recession comes next.

In the 1980s, under the quantitative theory of money, inflation was always and everywhere conceived as a monetary phenomenon. In today's context, this idea is unthinkable; it is not sure that there is too much liquidity in the food market and that it needs a reduction to slow down consumption.

Attributing high inflation to the special military operation is a limited response. When the military operation began, the US already had inflation of 7.9%. Since then, it accelerated by 0.6 % and has remained above 8.2 %.

The inflation currently observed is not transitory and has an explanation beyond the monetary aspect. The injection of liquidity due to the pandemic emergency gave it a boost through speculation in the commodities market, the purchase of assets and the expansion of credit.

The economic recovery of 2020 restored demand faster than supply. Supply faced temporary closures due to quarantines, which led to uncoordinated production chains. It was a sign that the global production and trade structure was more fragile than expected.

The start of economic sanctions against Russia in February 2022 saw sharp increases in the prices of oil, gas, basic grains, metals and various commodities. Unlike in 2020, this did not stop world trade but only reiterated the fragility of global value chains.

Under the idea of free trade, the offshoring of production led to the existence of relevant players in the market. When any of these players are affected, the impact is global. It is why the Russian-Ukrainian conflict had such an impact. To the extent that, despite the sanctions imposed, Russia has even increased its oil revenues.

While the US and Europe accuse Russia of using food and fertilizers as weapons, Washington quietly urges agricultural and shipping companies to increase purchases and transport of Russian fertilizers. In the negotiations, the UN seeks to restore the export of fertilizers, grains and other agricultural products from Russia and Ukraine.

President Biden criticizes the profit margins of the oil companies, but these are the result of the free market, in which prices go as far as demand allows in the face of shortages. In other words, the current inflation is more structural than monetary.

The control of this inflation goes beyond monetary policy. Raising interest rates relieves pressure in some sectors and limits demand at the expense of employment, possibly inducing a recession. Commodity prices have already been depressed, returning to their near March 2020 levels.

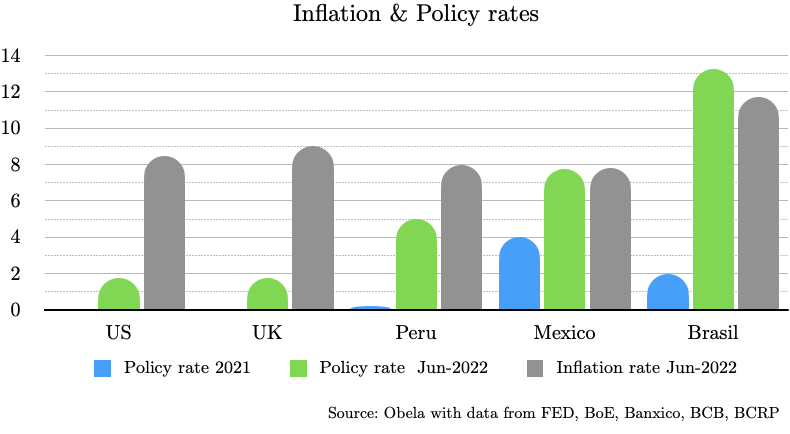

In Latin America, rates have risen sharply from their low point during the pandemic. Most notably in Brazil, where the interest rate increased by 1125 bps, the continent's only positive real interest rate. The most negative real interest rate is that of the US, with an actual yield of -6.75 %.

press conference on June 15 "Making appropriate monetary policy in this uncertain environment requires recognizing that the economy often evolves in unexpected ways. Inflation surprised to the upside over the past year, and more surprises could be expected."

press conference on June 15 "Making appropriate monetary policy in this uncertain environment requires recognizing that the economy often evolves in unexpected ways. Inflation surprised to the upside over the past year, and more surprises could be expected."

In this context, Treasury Janet Yellen recognized that Washington's desire to punish Russia for its military operation in Ukraine through sanctions has negative consequences for her country, including unacceptably high inflation. She made an unorthodox proposal for price control: forming a global bloc to limit oil revenues.

The FED faced the complicated task of stabilizing prices and chose aggressive interest rate hikes, which did not solve the underlying problem and led the West into a recession. It is necessary to take specific structural and fiscal measures to unblock supply bottlenecks and minimize the effects of the economic downturn.

Download / Español