Money as a commodity

- blog de anegrete

- 1897 lecturas

This article argues that a year after the COVID-19 global shutdown, exchange rates responded more to financial markets than macroeconomic conditions because of the depth that financialisation has reached in the global economy and the influence of the Fed (US Federal Reserve) policies have on exchange rates.

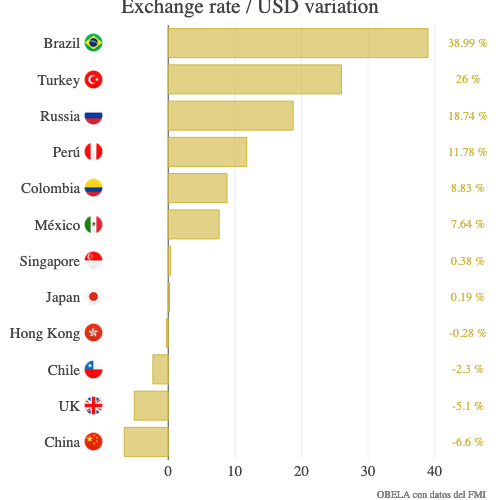

Unlike the textbooks, where exchange rates reflect economic growth, inflation, and international reserves, nowadays, the relationship to these national variables is increasingly questionable. For example, sterling appreciated 5% from January 2020 to March 2021, while Britain (GB) maintains a current account deficit, rising debt levels, and international reserves that cover only two months of imports. Conversely, in the same period, the Russian rouble depreciated nearly 20%, although Russia maintains a current account surplus, a low level of debt, and its international reserves cover 14 months of imports. Latin America experienced historical, current account surpluses while currencies depreciated simultaneously between January and March 2020 and then recovered after the FED intervention of March 18, 2020. The exception is the Brazilian real, which continued declining between March 18 and December, while their central banks accumulated international reserves.

Central bank intervention on exchange rates has been minimal. In general, the monetary base increased, accompanied by increases in international reserves, except for Brazil and Chile, which lost funds.

After financial deregulations, 21st-century exchange rates seem more responsive to financial markets than actual economic variables. This relationship becomes more profound as the financial sector increases its importance in the global economy. This relationship between the exchange rate and the financial market in each country becomes symbiotic because local currencies become a means to enter the financial market. Hence, their supply and demand become very sensitive to the financial market.

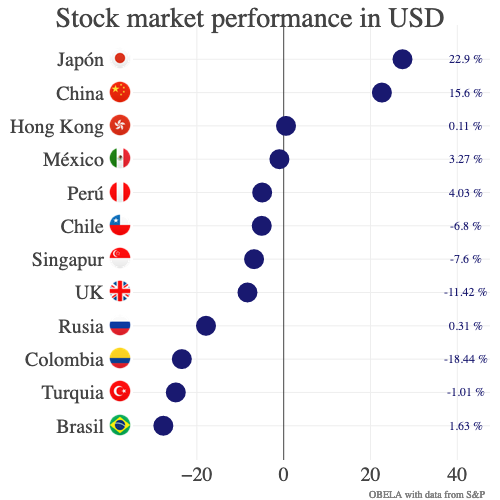

The dollar, the most traded currency in the financial markets in 2021 [Swift] with 87% of total transactions, 2% more than in 2019, showed a depreciation against all currencies, between March and December, as a result of the quantitative easing launched by the Fed on March 18, 2020, equivalent to 15% of US GDP. Simultaneously, larger financial markets with strong currencies, such as Beijing and Tokyo, recovered the losses seen after the lows in March and generated gains in December. Their indices outpaced the growth of US indices, and their currencies appreciated.

Offshore markets strongly linked to UK financial institutions have failed to recover the losses suffered in the early 2020s, partly due to Brexit's uncertainty and the 20% drop in the UK economy in 2Q2020, equivalent to 10 years of growth.

In some emerging financial markets, such as Mexico and Chile, their currencies were more volatile and highly correlated with their financial markets. Still, it was possible to recover to a limited extent the depreciation of the period January-March 2020 losses and their currencies in December are at levels similar to those observed before the pandemic.

Brazil, Russia, and Turkey had a minimal recovery of their stock markets. It suffered the strongest depreciations in this period, but those currencies have been trending downwards consistently over the last few years. In the short term, these currencies respond to financial markets but continue their depreciation trajectory in the longer term. Smaller markets, in terms of capitalisation, or at an early stage, have a more limited impact on the exchange rate, such as Peru or Paraguay.

Large markets such as Japan, China, or the US maintain yields above 20%, emerging and offshore markets such as Mexico, Singapore, or Hong Kong after the exchange rate conversion have a yield close to 1%.

The most difficult markets are Colombia, Brazil, Russia, and Turkey. Colombia has not fully recovered from the losses in the financial market, the COLCAP, its main financial index, fell by almost 50 %, accompanied by a 25% depreciation of the Colombian peso.

The appreciated currencies belong to countries with large financial markets, such as the Chinese Renminbi and the Japanese Yen. The money of emerging and offshore markets maintains a level similar to that before the pandemic; the most challenging markets are those that remain depreciated.

As we have seen, exchange rates respond to financial markets. As financial markets react to the Fed's liquidity injections, the price of currencies links to the US dollar's liquidity expansion rather than its domestic macroeconomic conditions.

In the short run, the abundance of liquidity drives financial markets, leading to the exchange rates. In the long run, a tightening of US dollar liquidity will create the reverse effects. Since the exchange rate responds more to financial variables than real ones, it does not affect everyone equally. The depth and degree of development of each country's financial sector will matter.