RCEP: the great asian free trade agreement

- blog de cdeleon

- 1735 lecturas

Amid the turbulence caused by the COVID-19 crisis, the world's largest free trade agreement (FTA) was signed. The Regional Comprehensive Economic Partnership (RCEP) consists of 15 countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam (ASEAN), China, Japan, South Korea (ASEAN +3), New Zealand and Australia. The ASEAN Economic Community Plan 2025 proposes that the region integrates into the world economy through FTAs. This new treaty is a further step towards achieving this goal.

The RCEP has as its background two proposals for the integration of the Asian region. In August 2006, Japan proposed the Comprehensive Economic Partnership for East Asia (CEPEA) at one of the ASEAN Summits. This initiative intended to integrate ASEAN, South Korea, China, Japan, Australia, New Zealand, and India. Based on the East Asian Free Trade Agreement (EAFTA), this now integrates ASEAN+3. All of these are currently in the new treaty.

The introduction of the RCEP idea to the ASEAN occurred in November 2011, and negotiations began a year later. The treaty came to life finally on 15 November at the ASEAN 2020 summit held online. The new integration scheme represents one-third of the world's GDP and population. It contains large asymmetries between the countries' per capita GDPs and whole communities, highlighted as follows: Brunei, 1500 dollars of GDP per capita, and South Korea, 31,000 dollars. China has 1.4 billion people, while Brunei has just over 450,000.

The treaty covers the following issues: trade, investment, financial and digital services, intellectual property, and technological cooperation. As regards the mobility of people, the countries will only admit temporary visits with visas. It is a limited trade treaty and not an economic integration process, with free factor movements. The WTO will carry out dispute resolutions according to its rules, and in case of an existing bilateral treaty, the forum is to be chosen by the complainant country. There is no provision for employment, government subsidies, nor the environment.

The technological cooperation that aims to reduce the development gap between the countries of the region is noteworthy. This is where China and its low-cost technological advances come in. The implementation of Chinese technology in the ASEAN member countries already existed before, mainly in energy. In Southeast Asia, China has already installed 52,573 MW of electricity, mostly from fossil energy sources. It seems that China invests in countries with lower per capita GDP in dirty energy because of its low technological and power generation costs, such as Laos and Cambodia. Indonesia also receives coal-fired power generation technology because of its large coal production (fourth in the world) and lax environmental policy.

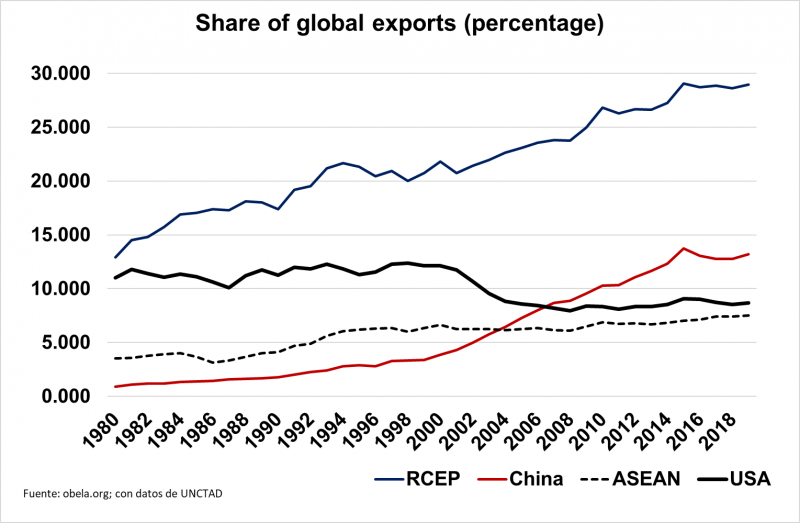

The new region accounts for 29% of world exports. Five non-ASEAN countries (China, Japan, South Korea, Australia, and New Zealand) account for the region's trade drag. However, ASEAN's share of trade is also remarkable, with 7% of world exports approaching the US's importance.

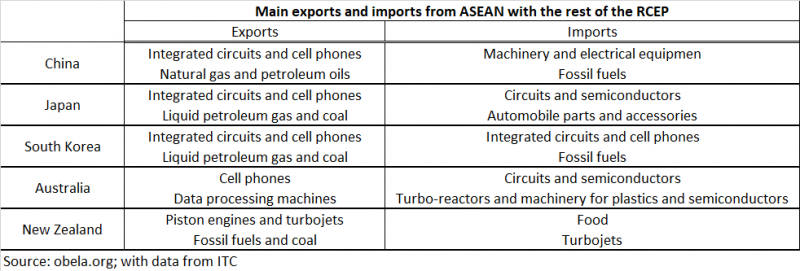

If we review the main exports and imports, we can notice the global value chains (GVC). The logic is that mobile phones, semiconductors, and circuits are worked on in ASEAN member countries for export to the rest of the RCEP. The Asian high technology industry will become more dynamic with the removal of tariffs. Similarly, fossil energy exports appear as relevant from Southeast Asian countries to the new members.

Foreign direct investment (FDI) will also benefit. Among all the RCEP countries, Japan, China, and Indonesia are in the lead with intraregional investment. The first two focus on investment in transport equipment. China stands out from the New Silk Road. Indonesia is the leading intraregional ASEAN investor with the following business groups: Lippo (telecommunications, health services, and retail), Salim (food, energy, telecommunications, and banking), and Triputra (manufacturing, food, and mining). Australia has been actively investing in the mining and technology industry since 2018.

With the treaty, China can have more regional influence, especially with partners with trade disputes: Australia, Japan, and South Korea. It also has more room for maneuver in the plans for the Strip and Route initiative. The Action Plan "Standard Unicom Builds the Belt and Road (2018-2020)" stipulates that by 2020 cooperation with ASEAN will be strengthened and improved. Even the Third Plenary Session of the 18th Central Committee of the Chinese Communist Party proposed the signing of trade agreements accelerated by 2020 to establish a free trade network for political and economic benefits.

China wins a vast trade agreement that plants it as the new face of multilateralism, in the front of its abandonment by the United States. International cooperation has taken on a new dynamic with China at the forefront with long term regional planning.